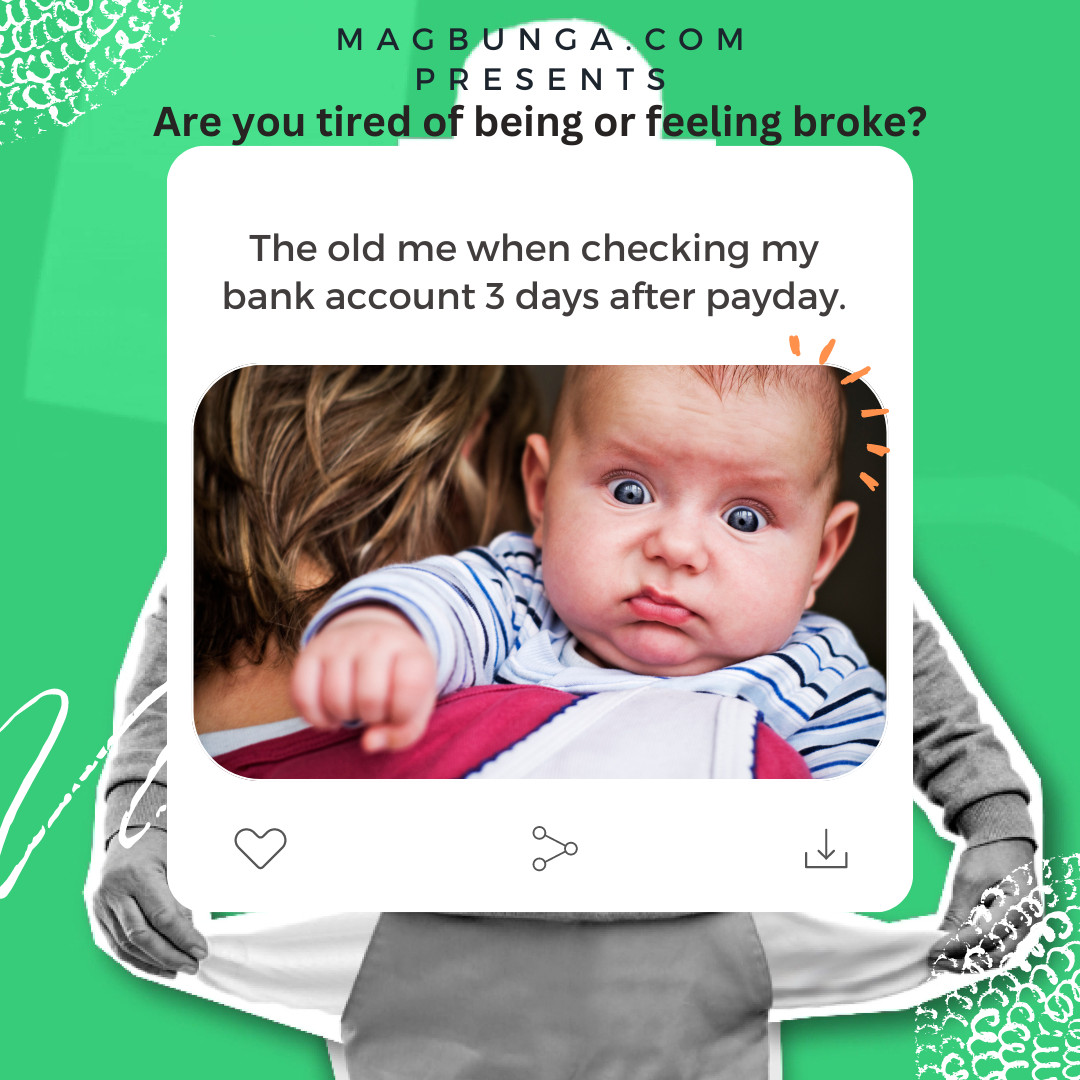

Are you tired of being or feeling broke? If so, you are not alone. I have been hearing multiple reports about the number of Americans living paycheck to paycheck and it is astonishing. Below is copied from the web and was the first result when I looked for percentage of people living paycheck to paycheck. Scroll down below for the rest of this post.

78%

A 2023 survey conducted by Payroll.org highlighted that 78% of Americans live paycheck to paycheck, a 6% increase from the previous year. In other words, more than three-quarters of Americans struggle to save or invest after paying for their monthly expenses.

Majority of Americans Live Paycheck To Paycheck – Forbes

www.forbes.com/advisor/banking/living-paycheck-to-paycheck-statistics-2024/

Personally, I lived this way for most of my life and it was horrible. If this is where you are at today and you are right there beside 3/4 of Americans who are just trying to stay afloat and make ends meet then this post is for you.

No one wants to feel broke and even worse no one wants to actually be broke. For my girlfriend and I feeling broke is when we are down to roughly $1000 dollars in the bank even after all the bills are paid. Now mind you I have a bit of money growing in my 401K, but we don’t really count that because it’s not really liquid and if we needed it in a pinch, it would cost more than it’s worth to borrow from it.

Now on the one hand yes, we can feel a little more at ease than some because we have learned and are still perfecting the art of living below our means which allows us to invest in our future. In my last post seen below I talked about how your life has more parallels to running a business than you may think.

If you are tired of being and or feeling broke, there is hope for you and I am going to help you get on the right track today. First off let me congratulate you on finding this post because it shows that you are ready to change your situation which is the first step. Step one is to get serious about where you are at and get even more serious about where you want to be.

Here is what this step is going to look like: be completely honest with yourself and the situation you are in. Living paycheck to paycheck, is extremely stressful and not very healthy for you physically, mentally, or spiritually. People living paycheck to paycheck are anxious and full of dread and terror every single month if not every single day. Being honest with yourself is about doing an inventory on where you are now and how you got there.

When I was living paycheck to paycheck, just a short time ago, my radiator went out in my BMW and I had to borrow the money to fix it from my girlfriend and I paid her back by the end of the month, but it made me realize how little I was saving for short term expenses. It wasn’t that I didn’t make enough money, it was that I just spent every little bit of it that I got all the way down to payday. So, if this is you then this is the second step for you now that you know where you are you can be more aware and ask yourself this very important question. Do I really need this, or do I just want it?

Step 2: is identifying wants and needs. You need to have a roof over your head especially if you have a family. You need to have electricity and running water to maintain a clean and healthy lifestyle. Whether or not you need a personal automobile is debatable and I could dive deeper into that another day, but let’s choose our battles. Internet and streaming services is not a need it’s a want, unless you use home internet for working from home and it is helping to pay the bills, then yes, it is a necessity and an investment that is paying huge dividends. Ordering pizza, using Door Dash, and other services which cost you an exorbitant amount of your net monthly income is not a need it is a want, and it is likely 90% of the reason you are broke or feeling broke.

Some of you might be making $100,000 or at least have a gross household income of $100,000 or more per year, which to some people may seem like a lot, but you find yourself still living paycheck to paycheck. Personally, I make a minimum of $43,680 which is $21/hr x 40 x 52 weeks a year, but with my girlfriend’s income we have an annual household income well over $100,000. We live a very comfortable life, but there are still lean times because her money is up and down throughout the year and just not all that consistent. Below is the number of Americans making six figures living paycheck to paycheck.

49%

Of those earning more than six figures, 49% reported living paycheck to paycheck, a jump from last year’s 42%.

Share of six–figure earners living paycheck to paycheck jumps, rep…

www.cnbc.com/2023/05/24/share-of-high-earners-living-paycheck-to-paycheck-j…

As you can see, nearly half of the people earning six figures are still living paycheck to paycheck which probably leaves them feeling broke even though they may have a lot of stuff and it may be really nice stuff. These numbers should be incredibly alarming because if people making six figures are living paycheck to paycheck how are those making less than that surviving? If you make less than six figures you are probably thinking if you made that much you wouldn’t be living paycheck to paycheck and feeling broke, but that’s most likely not true.

The reason I can say that is because of a little concept commonly referred to as “lifestyle inflation,” which is the idea that as you make more money and get raises, you start to spend more money.

The concept I am referring to is often summarized by the phrase “the more you make, the more you spend.” It’s a common financial behavior where increases in income lead to proportional increases in spending, sometimes referred to as lifestyle inflation. This can happen for several reasons:

- Perceived Affordability: As people earn more, they often feel they can afford to buy more expensive items or upgrade their lifestyle1.

- Spending as Reward: There’s a tendency to treat oneself to better or more luxurious goods as a reward for hard work1.

- Social Pressure: Higher earnings can lead to spending more to keep up with peers or societal expectations1.

- Diminishing Savings Intent: With more money, the urgency to save might decrease because the individual feels more financially secure1.

It’s important to be aware of this concept to avoid financial pitfalls and ensure that increases in income lead to increased savings and investments, not just increased spending. Financial planning and budgeting can help manage this behavior1.

Step 3: now that we have been honest with ourselves and now that we have identified our wants and needs, it’s time to start saving. If you don’t want to feel broke or be broke, then you need to be actively saving and investing if you truly want to be wealthy in the long run. If you are looking for some sort of, get rich quick scheme, be prepared to stay broke. True wealth is built over time, and it is built while you are sleeping. What I mean by that is once you start investing in assets such as your 401K or other investments such as real estate, these things are going to earn you money while you sleep and that is where you start to build real wealth.

After I started my job a couple of years ago, I invested in my 401K for one quarter and I had invested roughly $1200 of my own money and then I stopped for a few quarters, and I just watched the money grow from $1200 to $1500. Once I saw that, I decided ok this is definitely working and now I need to start investing again so my money can start making even more money. Now that I am roughly halfway through another quarter, I am sitting on a little over $2100 which is earning 6% at the time of this writing and during the next quarter I am going to go from contributing 7% of my gross income to 13-15%.

Step 4: is you need to find a way to increase your income so you can save more and invest more. If you have read some of my other posts then you probably know that I took a second job working for my friend’s appliance resale business, so that I could earn extra income. What I am doing off of that is restarting my marketing and advertising firm which is about to start bringing me even more income. It would be easy for me to start making this extra money and feel like I deserve new things because I have more money coming in, but that’s not the way I look at it.

The way I look at it is like I said earlier, I am going to up my contributions to my 401K from my full-time job so that I can earn and gain money quicker and in a more compounded way. The other thing about investing in something like a 401K through your job is that these are pre-tax dollars that you are getting to invest, and it reduces your taxable income, so it’s kind of a win win.

Lastly, and one of the most important steps that I talk about quite often is investing in yourself and your knowledge base. This kind of goes along with finding ways to increase your income because the more you invest in yourself and your knowledge base the bigger your skillset becomes and the easier it is to make and find money. A very easy way to build this knowledge base is by reading books and finding great videos on YouTube to learn more about a subject that you are passionate about.

You could also go to networking events especially if there are free ones in your area, because if you are broke or feeling broke then you don’t want to spend a lot of money at this point trying to get ahead. I could also say yes you might want to spend a little bit of money if it is truly going to help you make money in the long run, but know what you are getting into and make sure that there is value there and know that you are going to get a good ROI. For instance, if you are going to pay a coach or if you are going to pay for a course or seminar on how to make money then you want to know how much you stand to earn vs. what you are investing in the content. So, if you pay $2500 for coaching or a course or something like that then you want to know how quickly you are going to make that money back by using the new skills that you are paying for.

I’m going to end on this note: If you are broke or feeling broke, now is the time, not tomorrow, not next week, right now after you get done reading this post start doing the work to get out of your current situation. Follow the steps and maybe read a couple of my other posts because I don’t even want to go into the manifesting and law of attraction in this post, but these are also going to help now is just not the time. Right now, is the time to fix the basics and build the core and the foundation which are apparently a little shaky at best and then start to build on top of that. I will leave a few links to other articles, and I am going to leave a little link for a bonus download of the Magbunga.com affirmations which you should be going over daily.

As always thank you for your viewership and now please get out there and plant some seeds so you can start bearing the fruits of abundance now and in the future.

Founder Magbunga.com

Below is the free download that you can print or view on your digital device and below that is the preview of what you will be downloading. I hope you enjoy it and I hope it brings you much success!